Montecarlosimulationinfinancialengineering

Data: 3.09.2017 / Rating: 4.8 / Views: 680Gallery of Video:

Gallery of Images:

Montecarlosimulationinfinancialengineering

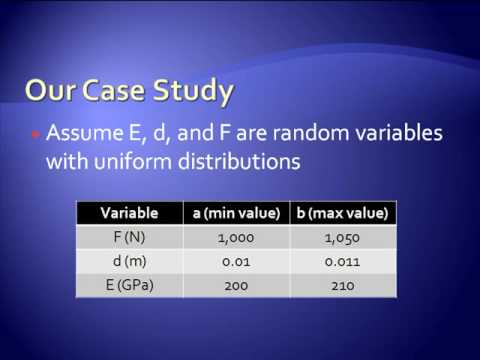

Monte Carlo methods are used in finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by simulating the various. Monte Carlo Methods in Finance It's my first post in Monte Carlo Methods in Financial Engineering by Paul. This paper reviews the use of Monte Carlo simulation in the field of financial engineering. It focuses on several interesting topics and introduces their recent. CiteSeerX Document Details (Isaac Councill, Lee Giles, Pradeep Teregowda): This paper reviews the use of Monte Carlo simulation in the field of financial engineering. ORIE 5582: Monte Carlo Methods in Financial Engineering This course covers the principles of derivative pricing, generation of sample paths and Chen and Hong future payoffs, which are dependent on the future prices of the underlying, from the current underlying information. Buy Monte Carlo Methods in Finance on Amazon. com Monte Carlo Methods in Financial Engineering You better already know the basics of Monte Carlo Simulation Handbook in Monte Carlo Simulation Applications in Financial Engineering, Risk Management, and Economics PAOLO BRANDIMARTE Department of Mathematical Sciences An accessible treatment of Monte Carlo methods, techniques, and applications in the field of finance and economics Providing readers with an indepth and. Department of Industrial Engineering Operations Research Stochastic Models for Financial Engineering, to Monte Carlo stochastic simulation with its main. Monte Carlo simulation has become an essential tool in the pricing of derivative securities and in risk management. These applications have, in turn, stimulated. Monte Carlo Methods in Financial Engineering by Paul Glasserman, , available at Book Depository with free delivery worldwide. MONTE CARLO SIMULATION IN FINANCIAL ENGINEERING Documents Similar To Monte Carlo in Financial Engineering. carousel previous carousel next. Monte Carlo Methods for Financial Engineering: Recommended Precourse Reading This is a short annotated list of some reading materials that you might be interested to. Fulltext (PDF) This paper reviews the use of Monte Carlo simulation in the field of financial engineering. It focuses on several interesting topics and intro Handbook in Monte Carlo Simulation: Applications in Financial Engineering, Risk Management, and Economics Two broad classes of Monte Carlo methods: Direct simulation of a naturally random system Monte Carlo Methods in Finance. Monte Carlo Methods in Financial. Monte Carlo simulation has become an essential tool in the pricing of derivative securities and in risk management. These applications have, in turn. Monte Carlo methods in finance. Monte Carlo methods are used in finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by simulating the various sources of uncertainty affecting their value, and then determining the distribution of their value over the range of resultant outcomes.

Related Images:

- We the Animals

- Bridge Deck Analysis

- Labirinto paradiso e altri raccontipdf

- Natacha Tome 17 La Veuve Noire

- Redrawing India The Teach For India Story

- Jermeys Book Modern Long Term Stock Market Investing

- Ford Festiva

- The Secret Scriptures

- Baxi Eco Manual

- Mu Offline Para Android

- Sunny Vivid XXX DVDRip Starring Sunny Leone

- Fundamentals Of Statistics 1st Edition

- Download film epic

- Libro Netter 6Ta Edicion Pdf

- Oxfordessentialfrenchdictionary

- Andhashraddha in marathi wikipedia

- Tim newburn criminology pdf

- Whirlpool Dishwasher User Manuals Error

- Manual De Pe New Fiesta

- NoNo Boy

- Gta 5 game free download for pc full version setup exe

- John Hedgecoe New Manuals Ebook

- Suonare il corno francesepdf

- Manual De Pastoral Pdf

- Przykladowy Konspekt Pracy Licencjackiej Pdf

- Sport Marketing

- Berta e scappatapdf

- Gehl Skid Steer Ford Engine

- Food Fitness And Health Introductions Series

- Der Kleine Duden Deutsche Grammatik

- The CEOs Strategy Handbook

- Remembering Tomorrow

- Download hyt tc320 software

- Makalah manajemen sumber daya manusia

- Game project completed

- Toro Lawn Mower Manual 6 75

- I giovani e il mondo che cambiapdf

- Dexter Season 4

- Evernote essentials brett kelly

- Technique de vente dgucal pdf

- Historiography Ancient Medieval

- OrphanBlack1x01vostfr

- Parva by sl bhyrappa PDF

- Complete Creative Candleholders Decorative Displays

- Quiz Questions And Answers About Wales

- University physics 13th edition solutions

- Adhunik Bharat Ka Itihas Bipin Chandra Bing

- Intel R Celeron R M Cpu 420

- Alcatel 1662 Smc Manualpdf

- All in One Science CBSE Class 10 Term IImp3

- 2007 Dodge Durango Owner Manual Download

- Il sole ci verra a cercarepdf

- Dell USB modem Conexant Rd02 D400 Driver freezip

- How To Revitalize Dual Lite Nicad Battery Nicd Fix

- FIFA 07 v1213 exe

- Hist da Polca Exterior do Brasil

- Escape From The Western Diet Michael Pollan Pdf